Stefan Austermühle, General Manager of Gemrock Peru September 2021

International payments are expensive. Often there are several service providers involved and each of them charges a fee. Additionally there are many times different rules around the world for money transfers. We at Gemrock Peru are trying to help you to avoid being overcharged by banks, to reduce your bank charges and to increase your profits, because your success is ours.

Bank charges cannot be avoided, but by understanding in detail how the international money transfer system works, we can choose between different alternatives and optimize our profits.

Traditional wire transfers

A wire transfer is nothing else than sending your money from your bank account to our bank account: bank to bank.

The bank that sends the money will charge a fee for doing so. However they will give you a choice: that is to pay the fee yourself or to charge this fee to the receiver of the payment.

As a general rule companies around the world will not accept that customers charge their bank fees to them, and neither would we.

We at Gemrock Peru are going to send you a quote for your products which will give you the amount that we expect to arrive on our bank account. We cannot, of course, carry the cost of your bank to send the money. Therefore it is important that you tell your bank that you will carry the costs for the money transfer. If you do otherwise this would result in an incomplete payment and we would ask you to pay the balance in a second money transfer before we can ship your goods, which will result in additional transfer fees for you.

Tip number 1 to reduce bank charges:

Do not forget to tell your bank that you will carry the fee for the wire transfer. This way you will avoid more charges for additional transfers required to complete your payment.

Gemrocks´ Startup Support

Starting a crystalshop (online or physical) is not easy – we know. But we believe in you and we have your back, because your success is ours.

We support startup companies with lower shipping prices. You can order without minimum amounts. We offer dropshipping and “Buy now, Pay later” agreements, as well as intensive business coaching.

In some rare cases some of our clients got a bad surprise. They paid their local banks fees and still we did ask them for a second balance payment because supposedly bank charges were not paid by them.

What did happen?

Some banks from other countries do not have direct ties to Peruvian banks. Instead they use an intermediate bank: Means your bank will charge you for wiring the money to a third bank in another country, but not the entire way thru.

This second bank, wires the money to our bank in Peru. Of course this intermediate bank will charge a fee for that and sadly such fees from intermediate banks are much higher. For example a bank from a client in Europe may charge the customer 20 dollars of transfer fee, but the intermediate bank may charge an additional 60 to 90 USD. We even had one case where an intermediate bank charged hefty 140 USD for wiring the money to Peru.

Normally a bank would inform you that the money will be transferred via an intermediate bank, which will charge an additional fee, so that you can decide if you want to carry such fees or if you want to charge such fees to the receiver.

It is obvious that we will not accept to carry such fees. We cannot know which of our clients use intermediate banks and which not. Therefore we cannot not incorporate such costs in our pricing structure. If you charge such costs to us we will necessarily ask you for a additional balance payment.

We also had one case were a client was not made aware of the fact that his bank would use an intermediate bank. So he only paid the local bank charges. The intermediate bank automatically charged the fees to us and we had to give the client the bad news of additional payments being required.

Tip number 2 to reduce bank charges.

If you are going to buy regularly from other countries, use a local bank that has a big enough network to have direct contacts to other banks around the world. Avoid banks that work thru intermediate banks in order to transfer your money. In any case, ask your bank if they have direct contacts to Peru. If their answer is that they will use intermediate banks, better look for another bank and avoid such charges at all.

If you don’t have the option to find a bank with direct contacts to Peru, you must state clearly to your bank that you will carry the transfer fees of the local bank AND the intermediate bank. This way you can at least avoid that we will ask you for balance payments which would result in even higher bank charges for you.

When your money arrives in our account, our bank will charge another fee for receiving it. They will charge us a flat rate of 22.- USD, no matter how big the amount was, that arrived on our account.

Our companies’ sales strategy aims to strongly support startup companies and small companies. Once you are registered with us, we are offering your company wholesale prices without any minimum order amounts. If you want to order products worth less than one hundred USD you are free to do so. If you just need one or two pieces of products we will help you.

However it is obvious that our profit to be gained from such small orders is very small too. Therefore we just cannot carry the bank charges from our Peruvian bank for small orders. This would eat away the biggest part of our profits. Therefore we will charge our Peruvian bank charges to our clients, whenever their order is smaller than 1000.- USD.

Also, if your order is smaller than 500.- USD, we will ask you for a 100% upfront payment.

If your order is between 500.- and 1,000.- USD we will give you the option of paying 50 % upfront and 50 % when your product is packed and ready for shipping. However you must be aware of the fact, that we will charge an additional 22.- USD of Peruvian bank charges for each of the two payments in case you decide to split your payment. Also of course you would have to carry your own bank charges twice.

If your order is bigger than 1,000.- USD and you decide to pay in two installments, we will charge you the Peruvian bank charges for one of those payments.

If your order is bigger than 3,000.- USD we will not charge you Peruvian bank charges, no matter if you pay in one or two installments. If you however decide to pay in more than two installments we would charge you the Peruvian bank charges for the third and any further instalment.

Tip number 3 to reduce bank charges

Make orders above 1,000.- USD, if you can, and choose to pay 100 % upfront. This way you will save greatly in bank charges on your side and on our side.

Ethical Crystal Sourcing

The Sky is the Limit!

We believe in global cooperation of like-minded companies and investors in order to earn money while changing the world for better.

Partner with us in this tide-changing spearheading initiative and provide your clients with 100 % traceable really ethical crystal products while protecting the environment, supporting fair trade and ethical labour conditions as well as fighting child labour.

And while making the world a better place, you will also make profits from on the project, have access to exclusive investor discounts and enjoy a free global marketing campaign resulting in an improved image of your bussiness and more clients.

Get a unique edge over your competitors.

PayPal Payments

We offer you the option to pay with PayPal, however we would like to make you aware of a few facts for you to consider.

Is PayPal safer then bank wires?

PayPals promotion creates the idea that your money is safe in case you buy something and have a problem with the provider. The PayPal-system may work in that sense in case you buy a finished product from a retailer in your country. It however does not provide you with any such safety like money recalls in the case of a production company like ours in Peru. Why is this?

When you transfer money with Paypal, the platform requires that you confirm within 48 hours that you have received the goods. Only if you click “goods received” your money will be processed and forwarded to the sellers account.

However, even if we have your product in stock the moment you order, international shipping will take 3 to 5 working days. It is obvious that in our case, PayPal is asking for the impossible.

That is why we only can accept PayPal payments if you are willing to confirm immediately that you have received the goods when you make your payment (even if that is not true). Because if you would not do that, we were not able to access the money and after 48 hours the money would be blocked and returned to your account.

However, we most likely require your upfront payment to arrive in order to start production. We must therefore make sure that we can access your money when you make the payment.

Please keep in mind that PayPal takes another 5 working days to transfer your money from our PayPal account to our local bank account. We will not wait 5 days till the money is on our account in order to start the production of your goods. We will start working for you immediately when your money appears on our PayPal account and we can visualize that you freed the money to proceed to our bank account.

What is cheaper: PayPal or bank wires?

The answer to that depends on how much money you need to pay. The bank fees from wire transfers are flat rates while PayPal charges are mostly percentages. So definitely using PayPal is cheaper when you are sending small amounts of money. But PayPal gets very expensive when you have to send bigger amounts of money as percentages for transfer and currency exchange are stockpiling with PayPal.

Additionally PayPal fees do change from country to country. While PayPal fees for the receiver in the USA are just 2.9 percent, PayPal charges us in Peru a hefty 6 %. To this one has to add a small flat rate of 0.3 USD. And there is an additional charge of 1.5 % in order to transfer the money onto our bank account. This sums to a total of nearly 8 %. To this you have to add fees charged to you as well as currency exchange fees.

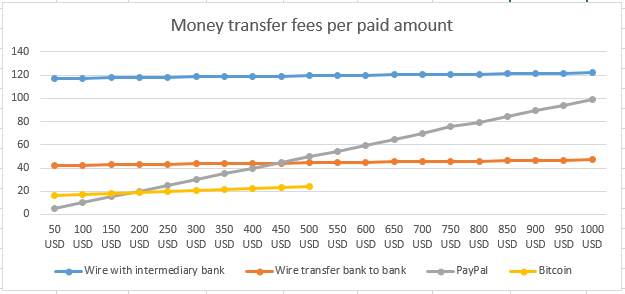

The following graphic is showing how the different payment methods differ according to the amount that has to be paid.

The blue line shows the hefty fees you would have to pay in case you wire money thru an intermediate bank. An options that, as said before, should be avoided.

We recommend PayPal (grey line) as payment tool for small orders. Depending on the country you live in the breakeven point between PayPal and bank wires is somewhere around 500 USD payments.

For all payments bigger than 500 USD bank wires (orange line) are much cheaper than PayPal payments.

The forth option (yellow line) are payments using cryptocurrency, an option that we will discuss below.

What are our policies concerning PayPal payments?

As laid out earlier we are happy to serve start-ups and small companies with orders that have no minimum order size. However we cannot carry the transfer fees for such orders, neither for bank wires nor for PayPal fees. This is why we will charge the peruvian PayPal fees to our clients.

We do recommend wire transfers for all orders bigger than 500 USD. While we are willing to carry the bank fees for wire transfers for bigger orders, we are not willing to carry the very expensive PayPal fees for bigger transfers as there is a cheaper alternative to PayPal. If you choose to use PayPal for payments above 500.- USD we will charge those payment fees to you.

Tip number 4 to reduce bank charges

Use PayPal for all payments smaller than 500.- USD. Use wire transfers for all payments bigger than 500.- USD.

Cryptocurrencies

Payments in cryptocurrencies are still seen by many with a great deal of scepticism, mostly because of lacking international regulation and lack of knowledge on how to manage such payments. However from time to time we are receiving requests from clients to consider cryptocurrencies as payment options.

We are currently looking into this payment method and are willing to experiment with it. However due to the very strong value variations of cryptocurrencies we currently only accepting payments of up to 500.- USD via cryptocurrencies and we only accept Ether and Bitcoin.

We are estimating the following bankcharges:

- 0.06% deposit fee of cryptocurrency in an international cryptoexchange (sender)

- Flat rate of 10.- USD charged by BITPOINT exchange to us.

- 1.18 % fee for transferring bitcoin in Peruvian soles to our bank account

- A 5.- USD flat rate charged by us as a safeguard against so far unforeseen exchange fees.

As shown in the previous graphic, payments in cryptocurrencies are the cheapest ways to pay for your goods and can be recommended especially for small orders between 200.- and 500.- USD

Tip number 5 to reduce bank charges

Learn about cryptocurrencies and experiment with cryptopayments for orders smaller than 500.-USD.

Is there a different payment platform which you would recommend or wich you would like to use?

Get in Touch

+51 994104206

gemrockinternational@gmail.com

Recent Comments