60 percent of crystal exports from wholesalers to crystal shops are declared wrong. Because of this crystal shops have to pay much higher import taxes than they should.

If you ignore this article

you might lose thousands of USD.

HS-Codes:

What are they and how do they work?

Connect with the author on LinkedIn:

Among industry classification systems, Harmonized System (HS) Codes are commonly used throughout the export process for goods. The Harmonized System is a standardized numerical method of classifying traded products. It is used by more than 200 countries and economies around the world to identify products when determining their treatment in customs tariffs and for gathering statistics.

The HS is administrated by the World Customs Organization (WCO) and is updated every five years. It serves as the foundation for the import and export classification systems used globally by all trading partners.

In practice, an HS code is a six-digit number that corresponds to one of more than 5,000 commodity groups singled out in the HS. Countries are allowed to add longer codes to the first six digits for further classification.

The first two digits in that code show the HS Chapter to which a specific product belongs, the third and the fourth digits indicate the heading within that Chapter, and the last two digits show the subheading within that heading.

In the case of crystals and carved crystal products, those are found in Section 13 (XIII): Manufactured Stone products, etc…

Within this section, Chapter 68 is for manufactured stone products, which means the first two digits to be applied are: 68

Within this chapter, the code 6804.23 is the correct one for products made from natural stone.

If you import or export silver jewelry with natural stones (cabochons) included, then the correct HS Code is 7113.11: Silver jewelry, including gold-plated silver.

Personalized Crystal-backed Silver Jewelry - Wholesale

Pyrite (and products made from Pyrite) have a special category. That is because pyrite is not only traded for decor or crystal energy but in its majority, it is traded as an industrial product because of its iron or sulfur content. This industrial product can be traded as “roasted” pyrite or as “unroasted” pyrite. “Roasting” is an industrial process of heating rough pyrite to eliminate certain chemical elements.

Given the fact that pyrite as a mineral has its own specific category, we can not apply the code for products made from natural stone to pyrite. “Natural stone” is a much more unspecific and broader term than “pyrite” to describe the product. By rule, the more specific term has to be used always. As our pyrite crystals and products are not industrially roasted, for all pyrite exports and imports the code 2502.00 for unroasted pyrite is the correct one to be used.

Most crystal wholesale providers do NOT understand HS codes.

This is not an intent to smear the competition: these are facts:

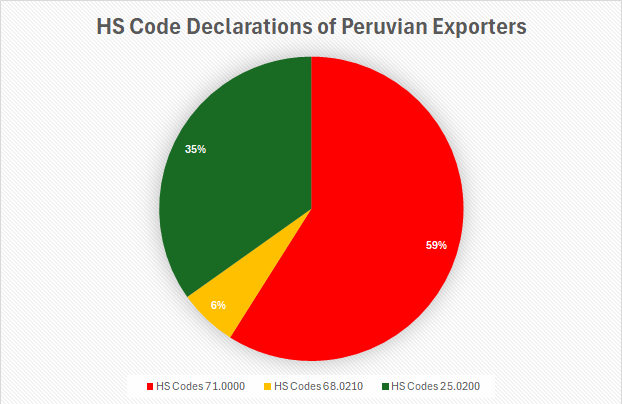

We analyzed customs data for all crystal exports from Peru for the last 8 years. The result is shocking:

60 % of exports from Peruvian crystal providers are handled using the wrong HS code causing up to 9% higher import taxes for the crystal shops.

Given the results of this analysis, we believe that it is highly likely that the same problem exists in other countries all around the world. If you want to protect yourself from losing money it falls on you to educate global wholesale dealers – sounds ridiculous, but seems to be a fact.

Therefore, let us dive deep into HS codes and import taxes:

1.) Rough pyrite and pyrite carvings are shipped in most cases falsely as “products manufactured from natural stones” when they should be shipped as “unroasted pyrite” with the HS code: 2502.00.

If we import crystal jewelry we would need to use the HS-code 71.1311.00. Import taxes for products with this Code are in Peru: 27% of the total sum of product costs + shipping costs.

If we import products carved from natural stones (spheres, pyramids, etc.) the correct HS code is 68.0423. Import tax for this code is 19.75% of the total sum of product costs + shipping costs.

If we import rough pyrite crystals or carved and polished pyrite products, the correct HS code is 25.0200 for “unroasted pyrite” and import tax is: 19.5 % of the total sum of product cost + shipping cost.

60 % of Peruvian Exporters do export pyrite and crystal products wrong under the code for semi-precious stone jewelry causing an overpayment of up to 7.5 percent in import taxes for their crystal shop clients. If you have a small order of 1000 USD (shipping plus product value) you are overpaying 75 USD for an error of your provider. The bigger your order the more you lose.

The numbers we gave you above are import taxes in Peru. Each country puts its own tariffs on the HS codes. Depending on where you live your losses may be lower or much higher.

However, there can not be any doubt that, in general, countries will charge higher costs for jewelry and semi-precious stones than for products made from natural stone. So there is no doubt that most crystal shops all around the world constantly overpay because exporters do not apply HS codes correctly.

As your provider does not feel the pain of financial loss, there is little chance he will correct this in the next export as long as you don’t demand it.

Nevertheless, it may help if you communicate to your provider that this is not only a problem for the buyer (YOU). What most exporters are not aware of is that such wrong declarations (even if not made out of bad intention, but out of lack of knowledge) can lead to fines, being imposed by customs even up to five years later (if it comes to a customs revision of a companies export history).

Unwise demands from importers

In some countries that import crystals and crystal products from Peru (especially India), there are high levels of corruption in the government and HS Codes are applied not by correct definition but by convenience. It is not rare for clients from such countries to insist that we as an exporter should use HS codes that they consider as financially the most convenient ones. This of course is rejected by us. We are not willing to expose our company to the risk of fines further down the road. This sometimes creates a very difficult relationship between exporters and importers.

You can buy our finished top-quality cabochons for jewelry makers.

National and international shipping from our US-based warehouse.

Customs officers may impose their own criteria

Some wholesalers export crystal products under one of the HS Codes of Chapter 71 (products manufactured from precious metals and precious or semiprecious stones). While it is correct that some of the crystals (by far not all of them) are considered semiprecious gemstones (like for example Lapis lazuli, Jadite-Jade, and Opal) that would only apply to cabochons made from those stones. All other products should be characterized as products made from natural stone. If your exporter, however, ships them out under the code for semiprecious gemstones, naturally you can expect a higher import tax.

An additional complication is that the allocation of taxes for a shipment is the responsibility of the individual tax officer working the case. It can not be expected from a tax officer to know millions of products and understand hundreds of industries. Therefore it is rather unavoidable that customs officers sometimes apply the wrong criteria. They can conclude that your crystal is not a product manufactured from natural stone but rather a semiprecious gemstone. And he simply recategorizes your shipment differently and you have to pay a higher import tax.

The problem for buyers is that first of all, they will never know what criteria a customs officer did apply because this information is nearly never shared with the importer.

And even if you would come to know it, filing a complaint against the criteria of a customs officer is an uphill battle you are likely to lose.

Gemrocks´ Startup Support

Starting a crystalshop (online or physical) is not easy – we know. But we believe in you and we have your back, because your success is ours.

We support startup companies with lower shipping prices. You can order without minimum amounts. We offer “Buy now, Pay later” agreements, as well as intensive business coaching.

What you can do

By reading this article you already took a step ahead, because you are now aware of a problem that nearly no one in the crystal industry is aware of. You can now reduce the likelihood of the use of the wrong HS code, which may lead to high taxes. That is an important step ahead.

We recommend you work only with wholesale providers who understand HS codes and apply them correctly and with your benefit in mind.

But there is something else you can do:

Avoid false value declarations

It is a widely distributed but bad habit to try to save import taxes by under-declaring the value of the goods. It is very common for clients, who are used to doing things the old way, to feel smart about this and ask us to declare a lower product value to save tax. There are several reasons why this does not work anymore in today’s world:

1.) At least in Peru, the databank of customs is directly connected with the database of the tax office and the tax office has direct access to banking information. So the amount of money that arrived in the company’s bank account has to be the same that was declared on the export bill. Otherwise, the exporting company faces high fines for false declarations. This closes a past loophole in the country of origin.

2.) It may surprise you, but the customs officers in the destination country do have internet and they do have access to value declarations of the same product by other companies. So importing a product with a very unusually low price in comparison to prices on the internet or values declared by other companies for the same or a similar product will give away the fraudulent attempt.

Our best advice: forget about this old trick. It is not smart anymore.

Free Gemrock Learning Resources

Free Gemrock Learning Resources

Connect wherever you want and can

Connect wherever you want and can

Get in Touch

+51 994104206

gemrockinternational@gmail.com

Recent Comments